YOUR SUPER POWER

As a topic, wealth creation may not be on top of your excitement list. However, do not underestimate its importance.

Most people will face some form of financial crisis or pressure throughout life, and having skills to navigate these situations is priceless.

In challenging times, individuals who manage cash inflows and outflows correctly and accumulate positive asset values are something of a superhero.

SMART DECISIONS

Most individuals have a limited income to play with. Wise people tend to put this money to good use and invest in wealth-creation assets.

2 of the most common wealth-creation assets are:

Housing

We all need somewhere to live, so as an asset, buying a home to live in is generally a sensible option. Further consideration is necessary for investment properties.

People often make the mistake of examining what they paid for it and what they sold it for but forget to include all the maintenance costs and interest paid on mortgages into the equation.

Superannuation

Few people know how to optimally manage super and most unknowingly defer control of this asset to the government. Anyone in MySuper falls into this category.

While MySuper should help you grow a retirement nest egg, you must check regularly to see if this is your best option. An alternative investment option with your current provider may provide a better long-term result.

If finance is not your strong suit, it pays to seek high-quality yet affordable super advice to help you make informed decisions.

Purchasing a home and taking control of your super early in your career are two key wealth creation objectives.

To put things into perspective, if optimised, your super will likely be worth more than the first house you can afford to buy.

Which asset do you pay the most attention to?

REVIEW YOUR SUPER

Use SuperWiser to complete a free super review and consider your options.

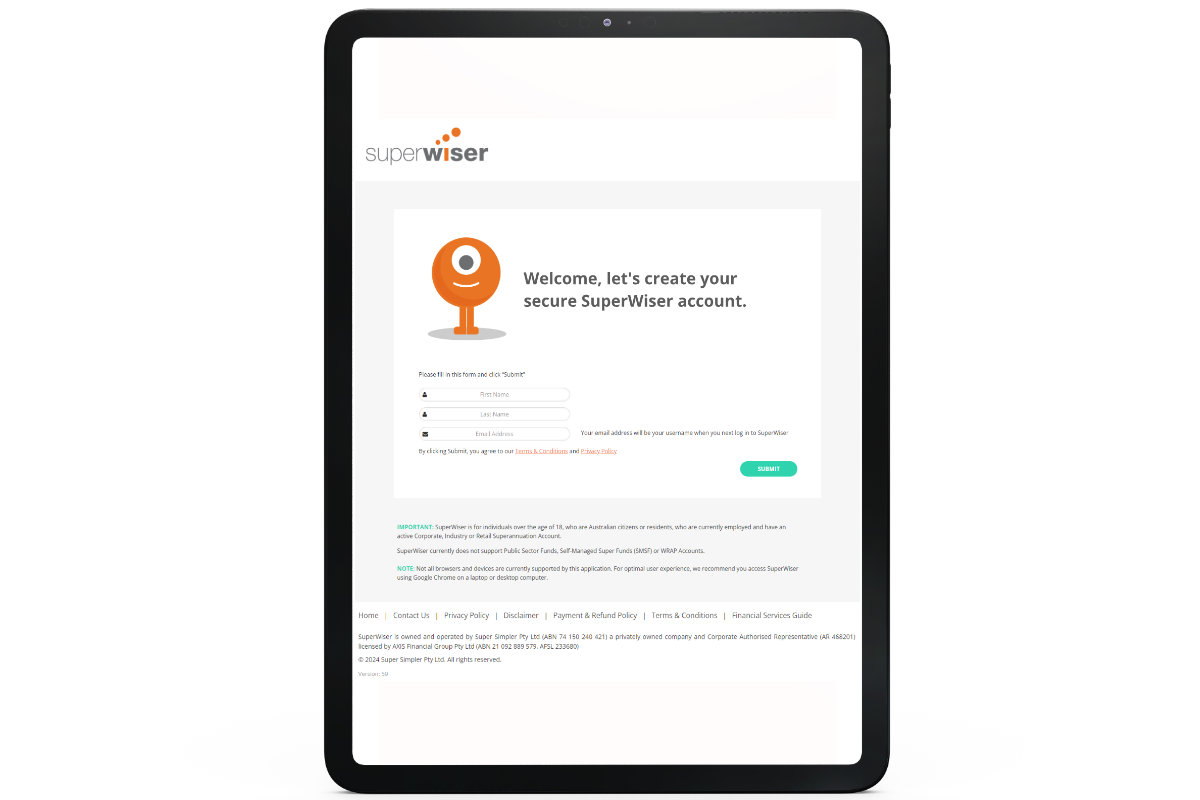

Create your secure SuperWiser account using your email address and then follow the instructions on screen.

This document was prepared and issued by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately-owned company operating as a Corporate Authorised Representative (CAR No. 468 201) of AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233 680). The information contained within it is not advice. It provides general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and consider talking with your financial adviser before making an investment decision. Information in this publication, which is taken from sources other than Super Simpler, is believed to be accurate. However, subject to any contrary provision in any applicable law, neither Super Simpler, nor its employees and directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

About

Your super is your money. It needs effective management for an optimal outcome. SuperWiser makes it easy to sort out your super. We compare many of Australia’s best-known super funds, identify which ones may better suit your circumstances and help you make timely, well-informed, ongoing strategic decisions, so you can potentially retire earlier and increase your wealth for retirement.

SuperWiser is owned and operated by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately owned company and Corporate Authorised Representative (AR 468201), licensed by AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233680).

© Super Simpler Pty Ltd 2025.

Contact Details

Business Hours

Mon – Fri 8:30am – 5:00pm (AWST)

Office Address

Suite 5, 250 Oxford Street

Leederville WA 6007

Postal Address

PO Box 7259, Cloisters Square

Perth WA 6850

Email

yoursuper@superwiser.com.au

Phone

1800 467 467

Some images used in website by freepik.com