Life is busy, and time seems to flow by quicker every year. Individuals often overlook the importance of their super as a wealth creation asset, because it is not immediately accessible and can seem somewhat complex.

Most younger workers are uninterested in the management of their super, failing to realise the compounding dollar value cost that arises from missed opportunities.

To achieve goals, you must take appropriate strategic action.

For optimal super outcomes, you must set goals, regularly review your strategy, and make tactical adjustments aligned with current circumstances and market conditions.

Since its initial introduction, the government and regulators have regularly introduced initiatives, supposedly to ensure that super is better managed and possibly optimised.

However, to date, best practice guidelines for individuals to establish long-term goals and short-term milestones and then manage their super accordingly are interestingly absent from any discussion.

The consequences of dismissing your super early in your career can be costly.

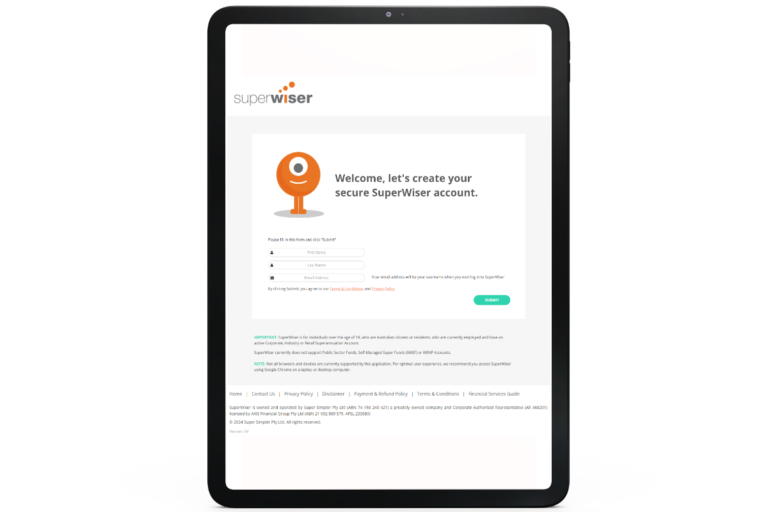

If finance is not your strong suit, it pays to seek high-quality yet affordable super advice to help you make informed decisions. SuperWiser is a client portal that does just that.

The first step to review your super is free. Upon your authorisation, SuperWiser communicates directly with your super fund to obtain relevant details and then calculates your baseline Projected Income in Retirement (in today’s dollars) based on your current approach. It also suggests if it can improve.

You then go through an initial process to help you establish long-term goals and objectives and implement product, contribution, and investment strategy advice recommendations. You also receive short-term milestones, which allow you to measure your progress.

After completing the initial advice process, SuperWiser will notify you when tactical updates are recommended based on market dynamics, regulation, and product changes.

There is significant confusion among consumers and within industry, media, and government regarding the definitions and roles of financial planners/advisers who provide personal advice and those who simply sell financial products.

SuperWiser is an online financial adviser application that provides personal advice to help you optimise your super consistent with your circumstances. It does not sell financial products.

Create a secure account using your email address, complete a free super review and examine your options.

Alternatively, call 1800 467 467 to speak directly to an adviser.

This document was prepared and issued by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately-owned company operating as a Corporate Authorised Representative (CAR No. 468 201) of AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233 680). The information contained within it is not advice. It provides general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and consider talking with your financial adviser before making an investment decision. Information in this publication, which is taken from sources other than Super Simpler, is believed to be accurate. However, subject to any contrary provision in any applicable law, neither Super Simpler, nor its employees and directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

About

Your super is your money. It needs effective management for an optimal outcome. SuperWiser makes it easy to sort out your super. We compare many of Australia’s best-known super funds, identify which ones may better suit your circumstances and help you make timely, well-informed, ongoing strategic decisions, so you can potentially retire earlier and increase your wealth for retirement.

SuperWiser is owned and operated by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately owned company and Corporate Authorised Representative (AR 468201), licensed by AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233680).

© Super Simpler Pty Ltd 2025.

Contact Details

Business Hours

Mon – Fri 8:30am – 5:00pm (AWST)

Office Address

Suite 5, 250 Oxford Street

Leederville WA 6007

Postal Address

PO Box 7259, Cloisters Square

Perth WA 6850

Email

yoursuper@superwiser.com.au

Phone

1800 467 467

Some images used in website by freepik.com