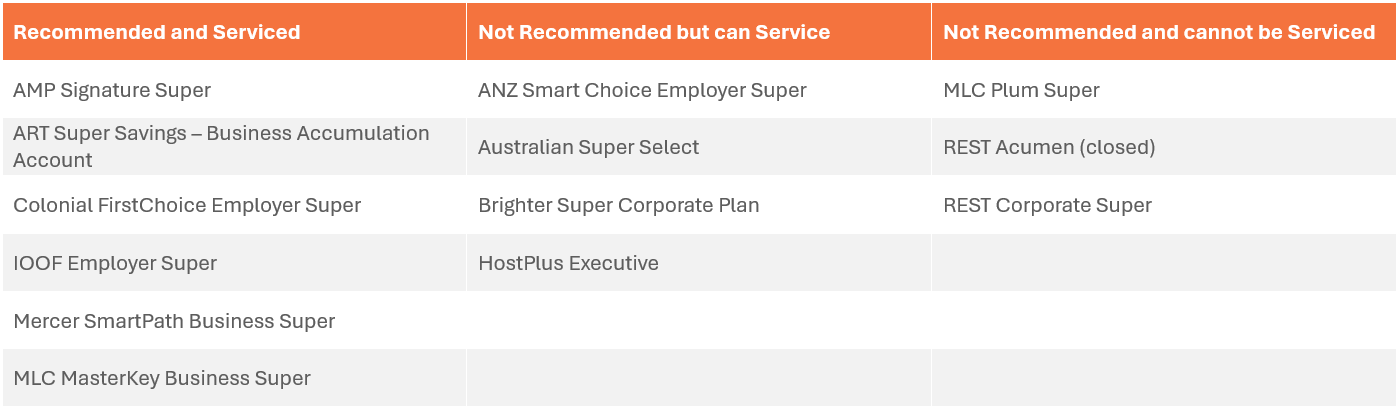

Approved Product List

Below are the current approved product list ratings for both corporate and personal superannuation.

Explanations on these results can be obtained by contacting SuperWiser to arrange an appointment.

Corporate Super

Personal Super

Asset Management Committee (AMC)

SuperWiser’s objective is to aid individuals in using their super asset as a form of wealth creation. We give people peace of mind that their super is properly managed and their strategies are optimized and aligned to their goals upon reaching retirement. We do this by providing personally scaled advice and ongoing management of their asset up to and even beyond the point of retirement.

The AMC is a core component of SuperWiser’s service model strategy and has responsibility for developing model portfolios from superannuation products on the Approved Product List (APL).

The main responsibilities of the AMC are as follows:

- Set the guidelines to manage the asset for different types of investors.

- Research different fund manager investment strategies to create model portfolios to achieve target returns (market + outperformance) using the available investment choice menu.

- Monitor the potential macro-economic conditions over the next 12–24-month cycle in order to ensure portfolios are aligned with expectations.

- Review model portfolio performance and report against the MySuper default option.

- Provide resources and training to the organization to ensure understanding of the decisions made by the committee.

The AMC constructs model portfolios for products on the APL to meet the needs of differing client types, i.e. Accumulators (High Growth through to Conservative risk profiles), Pre-Retirees and Retirees.

The AMC’s investment goal for accumulators (i.e. investors who have time in the market to grow their asset to a sizeable amount) is to manage constructed model portfolio to outperform MySuper returns over time. This approach is key to helping improve retirement outcomes.

For Pre-Retirees the goal is more about protecting capital from market volatility as they move into retirement phase, where focus switches to ensuring income needs are achieved in retirement and continuing to protect capital.

In constructing SuperWiser model portfolios, the AMC firstly establish the Strategic Asset Allocation (i.e., decide on the mix of growth and defensive assets) based on the risk profile type and establish a target market return objective for the portfolio type.

These are stated below:

The investment method uses a core-satellite approach to construct portfolios. There is a mix of low-cost index options to capture market returns combined with external single sector fund managers who have differing investment strategies to gain outperformance. Outperformance in the model portfolios is a result of the selection of the external fund managers. The index options allow for investors to have exposure in a diverse range of assets to minimise timing risk to capture upside or protect downside. Asset classes invested in are Australian Shares, Global Shares, Property & Infrastructure, Fixed Interest and Cash.

Decisions in relation to managed investments held within the model portfolios are based on independent research, the choice of investment platform, and the availability of quality investments. In addition, factors like geographical exposure, illiquidity, currency, and market risks against expected returns are taken into consideration.

AMC review holdings within the model portfolios on 1-to-2-year basis and in monitoring the portfolios, utilise a Dynamic Asset Allocation approach, i.e. consider market outlook to take advantage of valuable opportunities in specific asset classes and make changes to target potential return opportunities (including protecting capital in down markets).

Ultimately the AMC aim to outperform the MySuper option by up to 0.80% (High Growth), 0.70% (Growth) and 0.60% (Balanced) depending on the risk level of the portfolio and quality of the investment menu (i.e. APL rating). For Cautious and Conservative portfolios, the aim is to achieve the target market return only (no outperformance measure) over minimum investment timeframe.

The outcome of the AMC process is for products that are “Recommended and can be Serviced” or “Not Recommended but can be Serviced” with an advised model to provide an improvement in the Projected Income in Retirement outcomes compared to the MySuper default model.

Updated – February 2025