Assumptions

Accumulation Super Products Only

- All calculations assume super products are accumulation products as opposed to defined benefit products.

- As such, all calculations assume that your super account balance will receive all income and outgoings mid-year.

Results are in Today’s Dollars

- All calculation output values are shown in today’s dollars, which means they are adjusted for inflation.

Inflation Factors

The following assumptions are made relating to inflation:

- 2.5% each year due to the rising cost of living (CPI inflation).

- A further 1.5% each year due to the cost of rising community living standards.

Date of Birth

Super Setup Assessment – Indicative Results:

- Initially the calculation will assume your Date of Birth to be exactly {age years – 1 day} years ago (i.e. that your birthday is tomorrow).

Confirmed Super Setup – Semi-Personal & Personal Results:

- Confirmed actual Date of Birth value will be used in all subsequent calculations.

Calculation Date

- All calculations will utilise the “current date” (i.e. the date that the user clicks on the calculate button).

Concessional Contributions – Employer

Initially it is assumed that your employer contributes the mandatory super guarantee (SG) rate of 10.5% of your gross annual salary.

In future years we assume that:

- Your employer and voluntary contributions will increase with inflation.

- You will satisfy the work test at older ages and so are able to contribute.

- The employer contribution rate will increase by 0.5% per annum from 1 July 2021 until SG rate reaches and stays at 12% from 1 July 2025 onwards.

Where your employer pays over and above the mandatory SG rate this value will be captured as part of the “Goals & Objectives” section of the SuperWiser journey and subsequently used within Confirmed Super Setup calculations.

Voluntary Contributions – Salary Sacrifice

After-Tax Contributions

- Initially, no after-tax contributions are included within the Super Setup Assessment Indicative Results calculations.

- Semi Personalised calculations will include an after-tax contribution value as confirmed by your current super provider.

- The after-tax contribution value can be reviewed via the Variables hyperlink located on the Semi Personalised dashboard screen.

- As part of the “Goals & Objectives” section of the SuperWiser journey, you will be asked to confirm any after-tax contribution values. The confirmed value will then be used within your Personalised calculations.

Government Contributions

- No allowance is made for co-contribution within any of the calculations.

Low Income Superannuation Contributions

- No allowance is made for low-income super contributions within any of the calculations.

Excess Contributions Tax

- No allowance is made for excess contributions tax, whether concessional or non-concessional within any of the calculations.

Additional Tax for High Earners (Division 293)

- No allowance is made for additional tax paid by high earners within any of the calculations.

Results Shown As At 1 July

- Your projected super balance is shown as at 1 July after you reach the indicated age on the chart. For example, the super balance shown for age 65 is the balance at 1 July after your 65th birthday.

Investment Options

- All current super setup calculations assume you are invested in your current super product’s default investment option (i.e. MySuper Default).

- All proposed strategy calculations assume you are invested in a SuperWiser model portfolio aligned to your confirmed investor type.

- In setting an expectation around future returns, SuperWiser has an adjustment factor as a methodology to provide a unique “differentiation factor” to identify the superior fund.

- A superior fund is defined as a product which is likely to maximise income in retirement as an outcome for the individual client.

- Whilst fund performance was considered as a very important factor, there are other elements of the fund structure, such as transparency or liquidity of investments, and the level of risk with internal assets to achieve a better overall performance.

- Long term returns are usually promoted by all products wherever they are most favourable.

- Superior product as defined must demonstrate consistency over the long term, (usually 10 years).

- It is noted that warnings by the regulators are generally provided to discourage the public not to rely on past performance as an indicator of future returns.

- In addition, performance alone is not the only factor determining the adjustment factor.

- Standard Deviation was also considered as part of a group of other elements as being a more important element, but the level of risk was identified as being the most important element to influence the choice of fund over the medium term.

Adjustment Factor

The use of a unique “differentiation factor” referred to as the Adjustment Factor has been used to identify the superior fund options utilised within the SuperWiser application, which are likely to maximise the income in retirement as an outcome for the individual client.

Whilst fund performance was considered as an important factor, there are other elements of the fund structure, such as transparency or liquidity of investments, and the level of risk the fund takes with assets to achieve this return.

The key assessment and evaluation criteria used:

- MySuper design (growth / defensive asset allocation);

- Asset valuation methodology (i.e. levels of unlisted assets and liquidity);

- Investment choice menu suitability (i.e., asset sector access and core / satellite approach);

- Costing (i.e. administration and investment fees for standard member both High Growth and MySuper);

- De-risking model (i.e. investment choice versus model type used to reduce asset management risk in MySuper); and

- Insurance options (i.e. flexibility of the product to accept external insurers and overall product offering).

Within each of these key assessment and evaluation criteria there are sub-criteria depending on if the product is “Corporate” or “Personal” that score points. The total points scored under the assessment and evaluation criteria above determine a Total Outperformance Return (TOR) for each investment profile portfolio type.

Depending on the total score received the TOR awarded ranges from a maximum 0.8% for the High Growth profile to Nil in the Conservative profile. The TOR is the reward for consistency of performance, risk and volatility measures, supporting transparency indicators, and high-quality choice investment options.

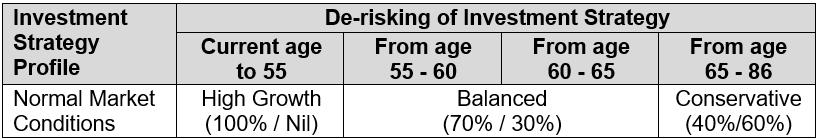

De-risking Methodology

The SuperWiser application, as part of providing client outcomes and recommendations, undertakes a super projection to calculate estimated annual income in retirement figures (both current and proposed) taking into account various assumptions, client/provider inputs, data sets and other factors.

While looking to promote a more active approach to both product selection and investment strategy selection (aligned to risk profile), and an active approach to asset management, SuperWiser developed a set of rules around de-risking the investment strategy.

This development effectively lowers the potential investment risk as an individual approaches’ retirement, and reduces the impact of significant market downfalls and sequencing risk closer to retirement. It also reduces the impact on an individual’s level of capital within super.

SuperWiser’s De-risking Rules

In order to provide a more reasonable outcome and in line with best practice in provision of advice, it has been decided to apply some general rules around de-risking a client’s investment strategy within the SuperWiser application as follows:

Investor Types

High Growth

Definition:

“You are seeking high returns over the long term (i.e. 7 years or more) of roughly 3.5% in excess of inflation. To achieve this, you’re willing to invest 100% in higher risk, growth assets. Security of capital is secondary to your goal of wealth accumulation.”

Strategic Asset Allocation (SAA):

- 100% Growth

- Nil Defensive

Return Objective:

- CPI + 3.5% p.a.

Asset Class Allocations (no Alternatives)[1]:

- Australian Equity 44%

- International Equity 50%

- Property & Infrastructure 6%

- Fixed Interest Nil

- Cash Nil

Market Return [2]:

- 6.0% p.a.

Target Return (above Market Return):

- 0.8% p.a.

Minimum Investment Timeframe:

- 7 years

Growth

Definition:

“You are seeking more capital growth than income over the longer term (i.e. 6 to 7 years or more) and returns of roughly 3.0% over inflation. To achieve this, you’re prepared to accept high levels of volatility and invest predominantly (approximately 80%) in growth assets, with the remainder (approximately 20%) in defensive assets.”

Strategic Asset Allocation (SAA):

- 80% Growth

- 20% Defensive

Return Objective:

- CPI + 3.0% p.a.

Asset Class Allocations (no Alternatives)[1]:

- Australian Equity 35%

- International Equity 39%

- Property & Infrastructure 6%

- Fixed Interest 15%

- Cash 5%

Market Return [2]:

- 5.5% p.a.

Target Return (above Market Return):

- 0.70% p.a.

Minimum Investment Timeframe:

- 6 years

Balanced

Definition:

“You are seeking slightly more capital growth than income over the longer term (i.e. 5 to 6 years) and returns of roughly 2.5% over inflation. As you’re keen to moderate the effects of tax and inflation, you’re prepared to invest predominantly (approximately 70%) in growth assets, with the remainder (approximately 30%) in defensive assets.”

Strategic Asset Allocation (SAA):

- 70% Growth

- 30% Defensive

Return Objective:

- CPI + 2.5% p.a.

Asset Class Allocations (no Alternatives)[1]:

- Australian Equity 30%

- International Equity 34%

- Property & Infrastructure 6%

- Fixed Interest 20%

- Cash 10%

Market Return [2]:

- 5.0% p.a.

Target Return (above Market Return)

- 0.60% p.a.

Minimum Investment Timeframe:

- 5 years

Cautious

Definition:

“You are seeking returns greater than cash and roughly 2.0% over inflation, with a low risk of capital loss over the medium term (i.e. 4 to 5 years). To achieve this, you’re comfortable investing approximately 55% in growth assets and 45% in defensive assets.”

Strategic Asset Allocation (SAA):

- 55% Growth

- 45% Defensive

Return Objective:

- CPI + 2.0% p.a.

Asset Class Allocations (no Alternatives)[1]:

- Australian Equity 27%

- International Equity 22%

- Property & Infrastructure 6%

- Fixed Interest 30%

- Cash 15%

Market Return [2]:

- 4.5% p.a.

Target Return (above Market Return)

- Nil

Minimum Investment Timeframe:

- 4 years

Conservative

Definition:

“You are seeking a very low-risk investment over the medium (i.e. 3 to 5 years) term. You’re prepared to accept lower returns of roughly 1.5% over inflation and the adverse effects of tax and inflation, provided there is minimal loss on your investment. To achieve this, you prefer to invest predominantly (approximately 60%) in defensive assets, with the remainder (approximately 40%) in growth assets.”

Strategic Asset Allocation (SAA):

- 40% Growth

- 60% Defensive

Return Objective:

- CPI + 1.5% p.a.

Asset Class Allocations (no Alternatives)[1]:

- Australian Equity 22%

- International Equity 12%

- Property & Infrastructure 6%

- Fixed Interest 40%

- Cash 20%

Market Return 2:

- 4.0% p.a.

Target Return (above Market Return):

- Nil

Minimum Investment Timeframe:

- 3 years

[1] Where “Alternative” investment options are available on an investment menu the APL Committee (APLC) may include this asset class subject to normal selection criteria and appropriateness of investment in the overall portfolio. The availability of alternatives is extremely limited on most corporate super fund menus. There are usually options available on wrap account menus. In the circumstances that an alternative is selected the APL would normally reduce the allocation to equities and property / infrastructure and reallocate accordingly.

[2] The “Market Return” reflects the return objective incorporating an assumed CPI rate of 2.5% p.a. This is the default inflation rate set out in the ASIC (Superannuation Calculators and Retirement Estimates) Instrument 2022/63 from January 2023. It is important to note that CPI is moving figure and when actually measuring performance of the portfolio over the investment timeframe the CPI figure may vary. The return objective is net of investment costs and tax only with these amounts deducted from fund earnings before declaration of final unit prices / returns (i.e. before deduction of administration and advice costs).

Assumed Tax Rates on Investment Returns

Investment Option – Cash

What it means:

100% in deposits with Australian deposit-taking institutions

Assumed tax on investment earnings*:

- 15.0%

Conservative

What it means:

Around 40% in shares and property. The rest in cash or fixed interest

Assumed tax on investment earnings*:

- 11.9%

Cautious

What it means:

Around 55% in shares and property. The rest in cash or fixed interest

Assumed tax on investment earnings*:

- 8.0%

Balanced

What it means:

Around 70% in shares and property. The rest in cash or fixed interest

Assumed tax on investment earnings*:

- 7.0%

Growth

What it means:

Around 85% in shares and property. The rest in cash or fixed interest

Assumed tax on investment earnings*:

- 6.5%

High Growth

What it means:

Around 100% in shares and property

Assumed tax on investment earnings*:

- 4.5%

* Actual returns will vary significantly from year to year and could be negative in some years, particularly for investment mixes where more is invested in shares and property. The SuperWiser calculation does not allow for such variations.

There is a lot to consider when comparing investment options between funds. Risk and return objectives and asset allocation within investment options may differ between funds and should be taken into account when comparing funds.

Tax File Number

- All calculations assume that you have provided your Tax File Number to your superannuation fund.

Administration Fees

- The calculation assumes the dollar per annum administration fees are charged mid-year on average and that the administration fees charged as a % of your balance are charged mid-year on average.

- It is also assumed that these fees are tax-deductible within super.

Contribution Fees

- The calculation assumes that contribution fees are deducted from your contributions as they as paid into superannuation.

- It is also assumed that these fees are tax-deductible within super.

Investment Fees

- Investment fees represent costs relating to the management of your investments that are directly deducted from your account.

- The calculation assumes that investment fees are charged as a % of your balance and are charged mid-year on average.

- It is also assumed that these fees are tax-deductible within super.

Indirect Cost Ratio / Indirect Costs

- Indirect costs represent costs that are deducted from investment returns before returns are applied to your account.

- The calculation assumes that the indirect costs are charged as a % of your balance and are charged mid-year on average.

- It is also assumed that these costs are tax-deductible within super and that tax deductions are applied before deducting these fees from the returns that are applied to your account.

Adviser Service Fees

- Initially, one-off and ongoing adviser service fees have been left out of the calculations for Indicative Results.

- It is assumed the dollar per annum adviser fees are charged mid-year on average and that the adviser fees charged as a % of your balance are charged mid-year on average.

- It is assumed that adviser service fees are tax-deductible within super.

- Semi Indicative Results assumes the Annual Ongoing Service Fee $ value as advised by your current super provider.

- You can review the Annual Ongoing Service Fee value by clicking on the Current Super Strategy Variables link located on the Semi Indicative & Personalised Dashboard screen.

- An Annual Ongoing Service Fee Index of 3.00% as been assumed and is applied to the Annual Ongoing Service Fee value as advised by your current super provider and shown in the Current Super Strategy Variables popup table.

- SuperWiser does not charge any Ongoing Adviser Service Fees therefore no Ongoing Adviser Service Fee has been factored into the calculation of any Proposed Super Strategy outputs.

- Subsequently where it has been confirmed that ongoing adviser service fees are currently being charged these fees have been factored into the current strategy calculation.

Insurance Cover & Premiums

- Insurance premiums are assumed to be charged annually to your account.

- Insurance premiums rates are assumed to be those that are disclosed within the Product Disclosure Statements for the corresponding super product.

- The same cover is applied to each product option on the basis that you require this amount of

Insurance premiums will be deducted in future years until age 65.

Super Setup Assessment – Indicative Results:

- Where you have advised “Yes” to insurance within super and “Fixed” as the insurance design the following cover amount is assumed for Death & TPD Insurance:

Age Range Amount of Cover:

- 18-25 $150,000

- 26-39 $250,000

- 40-49 $300,000

- 50+ $100,000

- Where you have advised “Yes” to insurance within super and “Formula” as the insurance design the following formula is used to determine the level of cover amount for Death & TPD Insurance:

- 15% of Salary x Years to Age 65

Confirmed Super Setup – Semi Personalised & Personalised Results:

- In order to provide a “like for like” comparison, a fixed level of insurance cover is assumed within the current & proposed calculations based on the level of cover you currently have in place as disclosed to us by your current super provider.

- The exact value of the fixed level of cover applied can be viewed within the Variables hyperlink popup table located on the output screens.

Further Information

- It is assumed that super contributions will remain in your super account until you have met a condition of release.

- It is recommended that you weigh up the benefits of contributing extra to super against your other priorities, for example paying off your credit cards.

Global Assumptions Applied to All SuperWiser Calculations

Pension Escalation Rate:

- 4.0%

Future Long Term Salary Increase Rate:

- 4.0%

Index Fixed Platform Fees (Member $ Fee):

- 3.5%

Returns CPI:

- 2.5%

Tax on Super:

- 15.0%

Index Annual Ongoing Service Fee:

- 3.0%

Concessional Contribution Cap (Any age from 2017-18):

- $25,000

Concessional Contribution Cap (Age >= 49 as at 30/06/2016):

- $25,000

Concessional Contribution Cap (Any age from 2021 – 2022):

- $27,500

Maximum Quarterly Super Contributions Base:

- $62,270 for 2023-24

Salary Factors

Salary Scale:

Age Salary Factor

15 1.0

16 1.0

17 1.0

18 1.0

19 1.2

20 1.4

21 1.6

22 1.8

23 2.0

24 2.2

25 2.4

26 2.6

27 2.7

28 2.9

29 3.0

30 3.1

31 3.2

32 3.3

33 3.3

34 3.4

35 3.5

36 3.6

37 3.7

38 3.8

39 3.8

40 3.9

41 3.9

42 3.9

43 4.0

44 4.0

45 4.0

46 4.0

47 4.0

48 4.0

49 4.0

50 4.0

51 4.0

52 3.9

53 3.9

54 3.8

55 3.8

56 3.8

57 3.7

58 3.7

59 3.6

60 3.6

61 3.6

62 3.6

63 3.6

64 3.6

65 3.6

66 3.6

67 3.6

68 3.6

69 3.6

70 3.6

Assumptions last updated: November 2023