YOUR PERSONAL ASSET

Your super is your money, a personal asset that requires attention because poorly managing it has significant financial consequences.

When tabling the introduction of super in 1991, Paul Keating stated: “Unless we can move (rapidly), we will put the Commonwealth Government age pension system under unbearable stress and condemn an entire generation of elderly people to an unsatisfactory and poorly provided retirement.”

Keating understood the importance of super and expected some negativity (even resistance) to its introduction.

One of the main issues with super is its relative complexity, which causes many people to put it into the ‘too hard’ basket and unwittingly end up with sub-optimal retirement outcomes. When managing your super as a personal asset, ignorance is not bliss. It can have a detrimental impact on your financial future.

Growth (whether personal or financial) requires acknowledging what you do not know, analysing the positives and negatives of the current situation, and creating an improved pathway forward.

ADVICE & SERVICE

Super takes some time to accumulate into a reasonable balance. People in their late forties and early fifties may look at their super balance and think they have done quite well for themselves, not realising they could have done significantly better had they made more informed choices throughout their careers.

The dominant market model for super provides inadequate service to at least 80% of the working population. Super products supply an account that registers your balance and asset value movements. They do not supply the knowledge to optimise your super as a personal asset.

Traditional financial planning services are typically too expensive for most people. However, more affordable services (like those offered by SuperWiser) are now available to help individuals better manage their super asset.

HELP IS AVAILABLE

Your employer has engaged SuperWiser to offer services to assist with money management and optimising your super.

To book a free financial awareness session, call 1800 467 467.

All meetings are private and confidential.

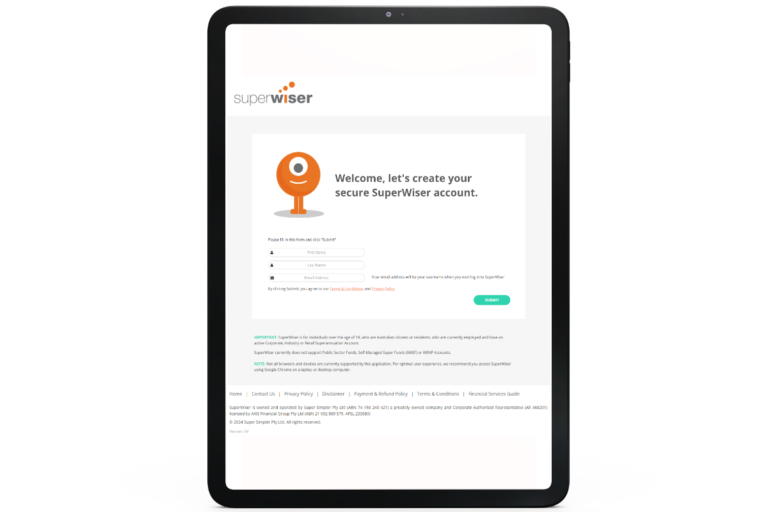

The SuperWiser online client portal can also expertly assist you with decision-making to target and monitor your super’s performance based on a scrutinised database of product information and investment portfolios.

Create your secure SuperWiser account using your email address and then follow the instructions on screen to complete a free super review.

This document was prepared and issued by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately-owned company operating as a Corporate Authorised Representative (CAR No. 468 201) of AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233 680). The information contained within it is not advice. It provides general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and consider talking with your financial adviser before making an investment decision. Information in this publication, which is taken from sources other than Super Simpler, is believed to be accurate. However, subject to any contrary provision in any applicable law, neither Super Simpler, nor its employees and directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.