OPTIMAL OUTCOMES

Irrespective of your age, the quicker you realise the importance of your super and take appropriate action to optimise it, the more money you could have to spend in retirement.

Optimal super outcomes do not happen by accident, there are steps to take and informed decisions you must make. Choosing an appropriate super product is just one of them. Not all super products are created equal, and few (if any) product providers make optimising your individual super balance their number one priority.

Currently, two of the most popular personal super products are competing against each other to achieve $500 billion in accumulated assets under management between 2026 and 2030. The priority is to increase their size and market position but not necessarily to help you personally better manage your super to optimise your projected income in retirement.

Your super is your money, and it is naive to expect to achieve optimal financial outcomes from any of the standardised default MySuper strategies.

You must actively engage with your super, consider how much super you will need to live your desired lifestyle in retirement, understand what adjustments you can make to your super strategy to achieve your goal and make regular updates throughout your career as conditions dictate.

WHAT’S NOT SO SUPER ABOUT SUPER?

All super products offer a system of recording historical movements within individual super balances and provide an annual statement of account.

Fees and insurance premiums can vary from product to product. Investment strategies are critical to the success of every individual’s super balance. Unfortunately, the importance of investment appears to be downplayed by super products, the regulator and the government. Promotion generally focuses on the standardised default MySuper investment options, all of which fail to take account of imminent market conditions and most provide a result not genuinely explained.

In summary, there are two main components to managing super effectively as an individual wealth creation strategy:

- Selecting an appropriate super product to historically record your balance.

- Accessing strategic advice to help you optimally manage the growth of your super asset throughout your working life.

Generally, super products excel in recording your historical balance but are very weak in providing personal strategic super advice.

BEST INTENTIONS

Most people have good intentions but fall short of taking appropriate actions.

The options to optimise super outcomes have always been available but generally overlooked, and not clearly explained by super products.

Most people tend to want someone else to blame for their failure to make appropriate and timely strategic decisions to achieve the level of super necessary to provide a comfortable lifestyle for themselves in retirement.

Your super has tremendous possibilities when you pay attention to it. The consequences of not engaging appropriately with your super can be costly, potentially reducing the amount you could accumulate by around 40%.

There are essentially four areas requiring ongoing attention if your super is to be optimised:

- Product Choice

- Cost Control

- Contribution Strategy

- Active Investment Management

If you do not have the financial knowledge to manage the effective growth of your super to the point of retirement, engage with a service provider who can educate you appropriately or advise you on what to do every step of the way.

PRODUCT CHOICE

Superannuation products often change in ways that you don’t hear about. A new product that enters the market or a change in existing product design can make a difference to the value of your super asset.

Determining which super product is most appropriate for you is essential, and because super is quite technical, seeking advice from a knowledgeable resource can be highly beneficial.

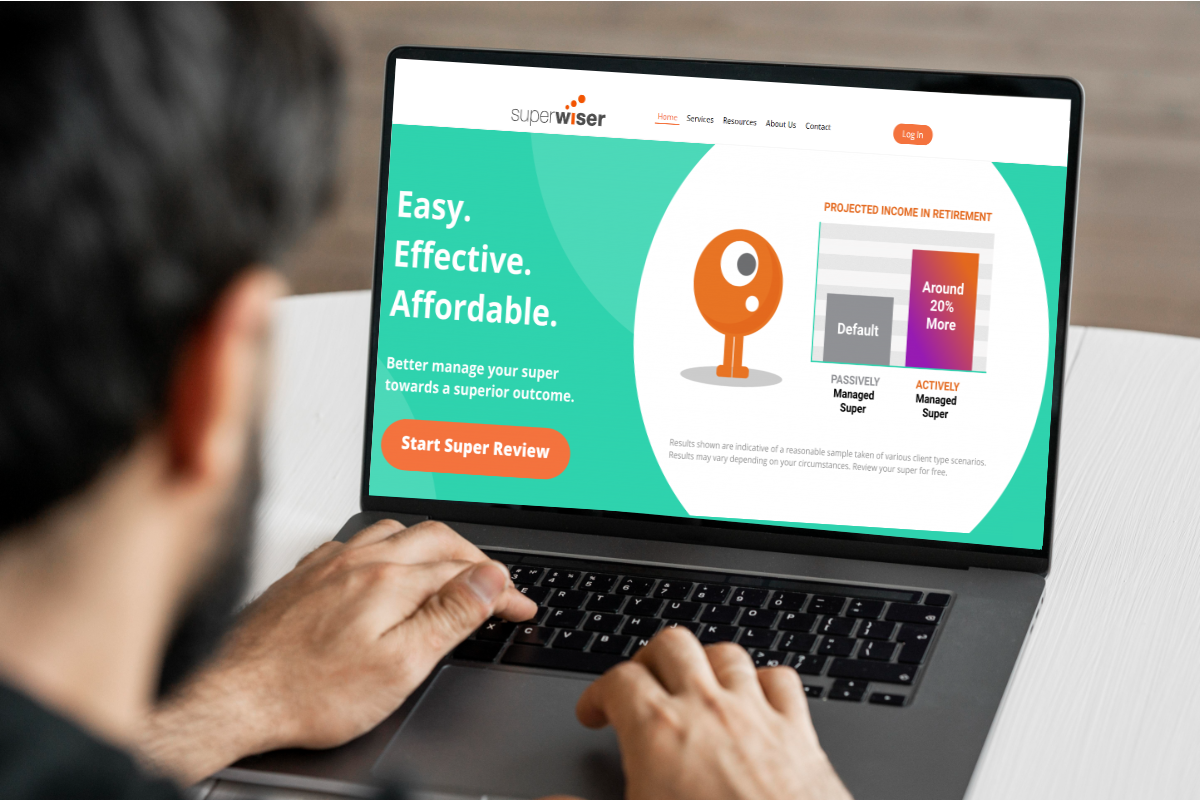

The SuperWiser client portal contains a database of over 30 well-known super products, which is constantly updated to reflect product changes, be it fees, insurance, investment choice menu or other functionality, and its purpose is to assist individuals with making informed decisions around super.

COST CONTROL

Anytime you change employer, reviewing your super fee structure is highly recommended.

Employers can often negotiate lower costs and insurance premiums for workers who join the employer super plan, so if you have not taken the time to compare your existing super product against the super plan offered by your employer, it is worth investigating.

You can complete a free super review using SuperWiser.

CONTRIBUTION STRATEGY

Every year or so, the government might change concessional and non-concessional caps, and it can be easy to miss opportunities if you are not paying attention to the impact of your contributions.

Once registered on SuperWiser, you will receive notifications of any change that might benefit your efforts to optimise your super balance.

ACTIVE INVESTMENT MANAGEMENT

MySuper is a default investment strategy, not an optimisation strategy (there is a difference).

There are three basic MySuper designs, and each one has deficiencies:

- A fixed design is generally a balanced portfolio, which means it is underexposed to growth assets for younger employees and overexposed to growth assets for older employees with a shorter time horizon before they access their super in retirement.

- A glide path design is where the bulk of your super asset gets invested in a growth (not high growth) portfolio, with future contributions invested conservatively somewhere in your fifties. This lack of attention to detail around investing means your asset is not optimised and is seriously over-exposed to growth assets, especially if imminent markets look precarious.

- Life cycle defaults are somewhat more sophisticated than glide paths, with age as the only de-risking factor considered.

SuperWiser helps you actively review and update your investment strategy every 12 to 24 months to ensure the right balance of growth and defensive assets reflective of market conditions expected for the cycle.

HELP IS AVAILABLE

The SuperWiser client portal provides access to affordable, expert advice and service specifically focused on assisting you to manage your super towards an optimal outcome.

WHY NOT GIVE SUPERWISER A TRY?

Create a secure account using your email address and complete the free super review.