A Considered Perspective

OVERVIEW

Given that the nation’s pool of super assets is approaching $4 trillion, one might assume its management has been effective.

Our two-party system of democratic government would surely advise the public if the rules applied to such an asset fail to optimise its growth at an individual account level.

Very few people endeavour to adopt the right wealth creation strategies with their super, displaying a lack of financial awareness that arguably pervades the overall management of their money.

STATISTICAL CONSIDERATIONS

Consider the data within the tables below.

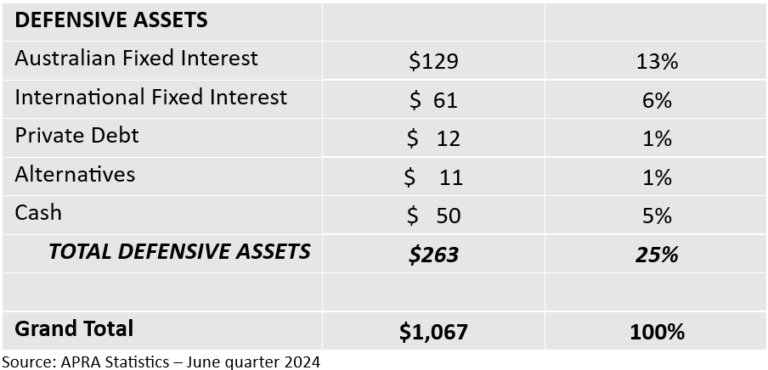

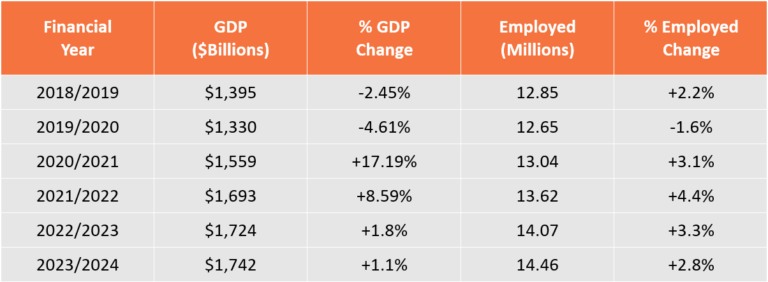

The value of asset as invested in the MySuper investment default is as follows:

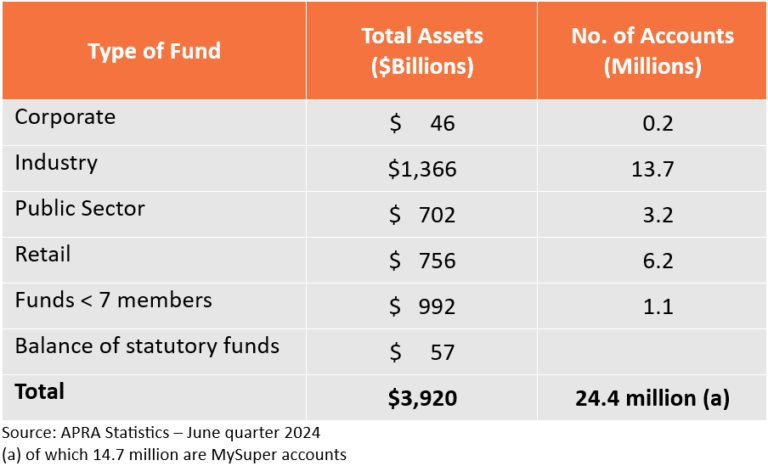

According to ASFA, Australia has approximately 24.4 million super accounts, totalling around $3.92 trillion in super assets. Of the total super accounts, 14.7 million (60%) is invested in MySuper products, accounting for around $1.07 trillion (27%) of the nation’s total pool of super assets.

These figures reflect that around 60% of workers assume that MySuper is the best investment strategy to optimise their super. Consider, however, that around 9.7 million (40%) of total super accounts equate to around $2.85 trillion (73%) of the nation’s total asset pool not invested in a MySuper product.

MySuper products may not be a bad option when starting in the workforce. However, they have design flaws and are possibly not ideal for those wanting to optimise super throughout their working life. The flawed design of MySuper products means younger individuals with a long investment time horizon are potentially under-exposed to growth assets, and older individuals with a shorter investment time horizon are potentially over-exposed to growth assets.

The Australian Financial Review recently reported that super fund giant AustralianSuper had to write off $1.1 billion from their private equity investments. So, understanding the exposure of MySuper products to unlisted assets and infrastructure, the level of illiquidity embedded in such investments and the level of risk is recommended.

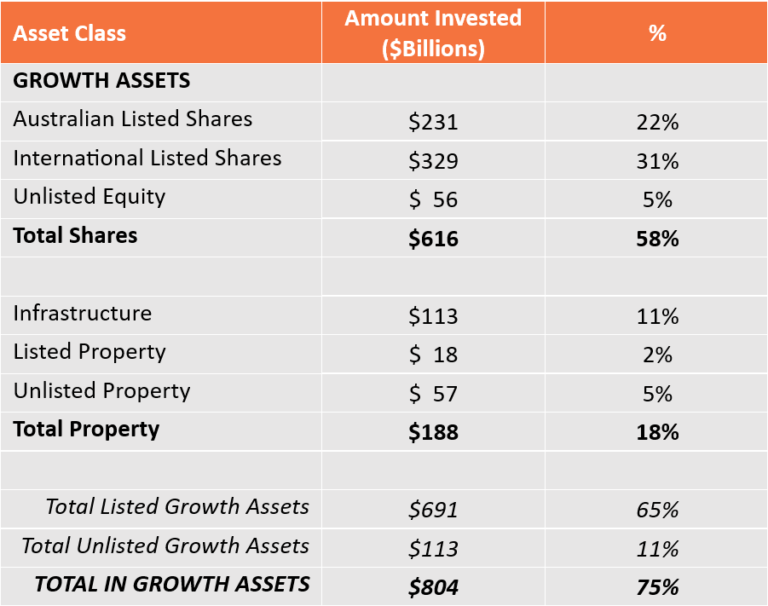

According to the Australian Bureau of Statistics, in 2020, the total number of employed people sat at 12.65 million. This number increased to 14.5 million as of February 2024 (a 14.3% increase from 2020) with a 4.2% unemployment rate. Consider the trend in employment numbers versus movements in gross domestic product (GDP) as detailed below:

A key question in determining what is happening in Australia requires an analysis of government spending and where the extra numbers are employed. Logically, if the additional numbers are privately employed, that should indicate a booming economy. However, economic indicators currently reflect otherwise.

ECONOMIC CONSIDERATIONS

A review of economic indicators reveals the precarious position of global markets. In 2008, dire problems within the global economy resulted in the Global Financial Crisis. Governments globally proceeded to ‘solve’ the problem by overstimulating their economies using prolonged record-low interest rates, high government spending on infrastructure, a universally agreed high use of quantitative easing for over a decade and significantly increased debt levels nationally and domestically.

Since 2008, governments have remained steadfast in policies stimulating economic activity, attempting to normalise global economies at a time when geo-political conflicts only serve to destabilise their efforts further.

Super is an area where mistakes and regrets are common, but when you better understand how super works and actively manage it, there is a significant opportunity to end up with an asset well beyond initial expectations.

SUPER CONSIDERATIONS

Your age, time horizon before retirement and size of your super balance are factors that require consideration regarding the points below.

- If you have multiple super accounts, consider consolidating them.

- If you are in a MySuper investment default:

- Consider if the asset allocation is appropriate to your circumstances and imminent market conditions.

- Ask questions about its asset allocation between growth and defensive investments.

- Understand the difference between listed and unlisted assets, the overall liquidity of the portfolio, why the current result is sustainable over the long term and any risks you may be unaware of.

REVIEW YOUR SUPER

Review your super for free using the SuperWiser client portal.

Create your secure SuperWiser account using your email address and then follow the instructions on screen.

ASSISTANCE

Alternatively, to discuss your options.

Phone: 1800 467 467

Email: yoursuper@superwiser.com.au

This document was prepared and issued by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately-owned company operating as a Corporate Authorised Representative (CAR No. 468 201) of AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233 680). The information contained within it is not advice. It provides general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and consider talking with your financial adviser before making an investment decision. Information in this publication, which is taken from sources other than Super Simpler, is believed to be accurate. However, subject to any contrary provision in any applicable law, neither Super Simpler, nor its employees and directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.