OPTIMAL OUTCOMES

Irrespective of your age, the quicker you realise the importance of your super and take appropriate action to optimise it, the more money you could have to spend in retirement.

Optimal super outcomes do not happen by accident, there are steps to take and informed decisions you must make. Choosing an appropriate super product is just one of them. Not all super products are created equal, and few (if any) product providers make optimising your individual super balance their number one priority.

Currently, two of the most popular personal super products are competing against each other to achieve $500 billion in accumulated assets under management between 2026 and 2030. The priority is to increase their size and market position but not necessarily to help you personally better manage your super to optimise your projected income in retirement.

Your super is your money, and it is naive to expect to achieve optimal financial outcomes from any of the standardised default MySuper strategies.

You must actively engage with your super, consider how much super you will need to live your desired lifestyle in retirement, understand what adjustments you can make to your super strategy to achieve your goal and make regular updates throughout your career as conditions dictate.

WHAT’S NOT SO SUPER ABOUT SUPER?

All super products offer a system of recording historical movements within individual super balances and provide an annual statement of account.

Fees and insurance premiums can vary from product to product. Investment strategies are critical to the success of every individual’s super balance. Unfortunately, the importance of investment appears to be downplayed by super products, the regulator and the government. Promotion generally focuses on the standardised default MySuper investment options, all of which fail to take account of imminent market conditions and most provide a result not genuinely explained.

In summary, there are two main components to managing super effectively as an individual wealth creation strategy:

Generally, super products excel in recording your historical balance but are very weak in providing personal strategic super advice.

BEST INTENTIONS

Most people have good intentions but fall short of taking appropriate actions.

The options to optimise super outcomes have always been available but generally overlooked, and not clearly explained by super products.

Most people tend to want someone else to blame for their failure to make appropriate and timely strategic decisions to achieve the level of super necessary to provide a comfortable lifestyle for themselves in retirement.

Your super has tremendous possibilities when you pay attention to it. The consequences of not engaging appropriately with your super can be costly, potentially reducing the amount you could accumulate by around 40%.

There are essentially four areas requiring ongoing attention if your super is to be optimised:

If you do not have the financial knowledge to manage the effective growth of your super to the point of retirement, engage with a service provider who can educate you appropriately or advise you on what to do every step of the way.

PRODUCT CHOICE

Superannuation products often change in ways that you don’t hear about. A new product that enters the market or a change in existing product design can make a difference to the value of your super asset.

Determining which super product is most appropriate for you is essential, and because super is quite technical, seeking advice from a knowledgeable resource can be highly beneficial.

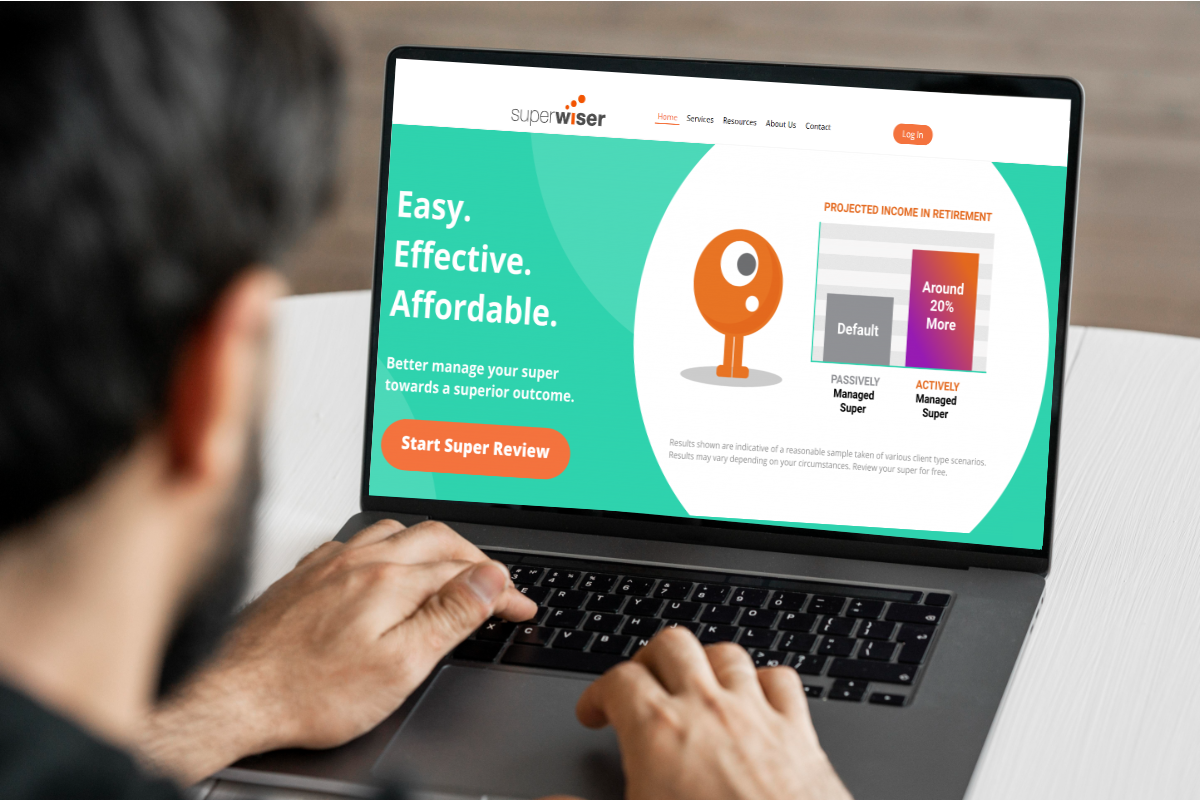

The SuperWiser client portal contains a database of over 30 well-known super products, which is constantly updated to reflect product changes, be it fees, insurance, investment choice menu or other functionality, and its purpose is to assist individuals with making informed decisions around super.

COST CONTROL

Anytime you change employer, reviewing your super fee structure is highly recommended.

Employers can often negotiate lower costs and insurance premiums for workers who join the employer super plan, so if you have not taken the time to compare your existing super product against the super plan offered by your employer, it is worth investigating.

You can complete a free super review using SuperWiser.

CONTRIBUTION STRATEGY

Every year or so, the government might change concessional and non-concessional caps, and it can be easy to miss opportunities if you are not paying attention to the impact of your contributions.

Once registered on SuperWiser, you will receive notifications of any change that might benefit your efforts to optimise your super balance.

ACTIVE INVESTMENT MANAGEMENT

MySuper is a default investment strategy, not an optimisation strategy (there is a difference).

There are three basic MySuper designs, and each one has deficiencies:

SuperWiser helps you actively review and update your investment strategy every 12 to 24 months to ensure the right balance of growth and defensive assets reflective of market conditions expected for the cycle.

HELP IS AVAILABLE

The SuperWiser client portal provides access to affordable, expert advice and service specifically focused on assisting you to manage your super towards an optimal outcome.

WHY NOT GIVE SUPERWISER A TRY?

Create a secure account using your email address and complete the free super review.

FORWARD PLANNING

Forward planning always begins with assessing your past. We all have aspects of life we know we manage well and some that we could manage better.

Unless we regularly take stock of our current situation, review what we have done to get to this point and determine how we can improve our future outcomes, we stagnate and miss out on beneficial opportunities. Super is an area where this is especially true.

MONEY MANAGEMENT

There is more to life than money, and becoming a multi-millionaire may not be our life purpose, but if you do not manage your financial affairs wisely, life can be more difficult than it needs to be.

Learning how to manage/mismanage money usually starts when you obtain a job that provides a steady income. It is financially wise to use earnings to buy an asset that appreciates rather than depreciates, yet most people tend to look for a car first, which is an asset but one that is worth less in the first week of ownership than what you paid for it.

Most people take a decade or more to develop a financially sound perspective on their cash flow, savings and acquisition of assets, and many opportunities to improve their circumstances during this time inadvertently fall by the wayside simply due to unawareness

FINANCIAL AWARENESS

Phrases such as financial education or financial wisdom are popular phrases often heard in different situations within Australia. People develop different levels of financial awareness depending on what they are responsible for.

Various levels of government play a role in the management of the Australian economy and initiate a range of priorities that do not benefit all but do benefit some. The segment of corporate Australia, be it large or small businesses, and the impact of decisions made around the national economy requires consideration, and so does the family unit or the individual trying to struggle upward through parenting efforts and then future generations.

If we all are to move forward and upwards in life, financial awareness is as much a necessity as care for your community, with the balance between both finely judged by someone or a body who has both financial wisdom and skills.

REFLECT AND REVIEW

Financially, what you do not do will always come back to haunt you. How many times in life will you be able to start again? The answer to that question depends on your age and the time available within your life horizon.

Effective management of your financial situation demands you base decisions that impact your future on knowledge acquired from reviewing your past.

Decisions made and implemented without adequate information are almost always wrong. An opinion backed up with the acquisition of evidence equates to fact-based knowledge. Making informed decisions increases the probability of achieving life goals.

SITUATIONAL ANALYSIS

Earn some money through employment, spend some or even all you earn, maybe save some before you spend that too, and accumulate an abundance of debt. The summary of life for too many well-intentioned individuals.

If this is the treadmill you are on, the first step in taking control of money is always to analyse the situation as it is. It is easy to make financial mistakes without even knowing you are making them, many of which are damaging in some way or other.

Growth (whether personal or financial) requires you to acknowledge what you do not know, analyse the positives and negatives of the current situation and create an improved pathway forward.

DECISION MAKING

Having developed and even documented a new or heavily modified perspective around the management of your income, savings, assets and liabilities, changes in behaviour will need to be adopted involving the rules you want to operate to and the goals you want to set for yourself and others who might be somewhat dependent on you.

Your future financial outcomes depend upon you knowing what you are doing, a process that requires considered steps in deciding what to do from here and engaging the services of a trusted professional who can answer your questions and help you make fully informed decisions can be beneficial.

CAREER DEVELOPMENT

Most people earn income plus super from employment, yet many do not actively develop their careers sensibly. It is critical to the development of your future financial situation that you succeed within your chosen line of employment.

Nowadays, every employee in their thirties will have accumulated $100,000 plus in super, a personal asset that likely would have already been spent if paid out as wages.

Very few people endeavour to adopt the right wealth creation strategies with their super, displaying a lack of financial awareness that arguably pervades the overall management of their money.

GET STARTED

Do not let any further opportunities to create more wealth for yourself pass you by. Set the intention to become more aware and develop financial management skills in 2024.

To attend a free financial awareness webinar email yoursuper@superwise.com.au

Or visit www.superwiser.com.au and complete a free super review.

SUPER AWARENESS

Depending upon your age, opportunities, and life experience, you might not yet realise the importance of your super relative to your financial future. Many individuals fail to ask the right questions regarding super, and even fewer consider how to make more super for their retirement.

Optimal super outcomes do not happen by accident. There are steps to take and informed decisions you must make.

STEP 1: REGULARLY ENGAGE WITH YOUR SUPER

You accumulate super via contributions made on your behalf by your employer. So, your employer funds your super, but ultimately, you are responsible for managing it as a personal asset.

The 2018 Royal Commission identified that, in general, the financial services industry paid more attention to maximising company profits as opposed to providing individuals with relevant, value-adding services at accessible prices. The resulting increase in regulations means the financial services industry now makes less revenue.

Instead of reviewing their existing market propositions and offering more beneficial services to clients, an exercise of cost-cutting has ensued within the industry, endeavouring to protect profit margins.

It is a mistake to assume anyone other than yourself will optimise your super asset. You must regularly review your superannuation strategy and make informed decisions that align with your circumstances and expected market conditions.

STEP 2: INCREASE YOUR FINANCIAL AWARENESS

Most individuals are arguably not as financially aware as they need to be, especially those at the beginning of their careers. One of the most important financial skills needing acquisition early in life is efficient money management. Most people can benefit from analysing the proportion of their income wasted on discretionary spending rather than using that money to repay debts quicker, increase savings or invest.

Various perspectives on money are necessary to develop your financial future. Super is a personal asset you will access in retirement, which may seem far away for some, but time passes quicker than you think. It is essential not to waste time as this can significantly reduce the amount of super you end up with. Even those with only a few years until retirement should ensure their super has the right strategic balance between growth and defence.

No one in the pre-retirement phase of their career wants to be caught unprepared in a market downturn.

STEP 3: MANAGE YOUR CAREER AND EARNING POWER

A significant determinant of your future financial position is your career. It dictates your earning capability. Irrespective of your occupation, you will face many choices and opportunities to seize the moment and maximise your earnings.

It also pays to be efficient with your spending habits and engage with beneficial services that can help you create more wealth from your assets, with super being one of them.

Simple ideas for managing your career to your advantage:

STEP 4: ACTIVELY MANAGE YOUR SUPER ASSET

Active management of your super asset requires every individual to make an informed decision around the following:

While the above decisions appear straightforward, there is much misleading information in the financial services industry about the best decisions to make and when to review them.

Every product provider is currently reviewing their default offering around investment and increasing the proportion of unlisted assets included in MySuper. Why? According to certain product providers, unlisted assets provide superior returns.

Interestingly, these product providers claim unlisted assets are less volatile than listed assets. Most individuals don’t know the distinct difference in the frequency of valuation between listed and unlisted assets or why it matters. Listed assets are revalued daily, with unlisted assets formally once a year.

The market examines the annual performance of comparable MySuper default products every July and assumes that higher returns must signify the preferred product. But is this true?

For the following reasons, individuals should not rely solely on super product providers to help them optimise their super, because:

Super products change every year, and without a significant amount of time spent reviewing and a technical understanding of super, no one can expect to know what product is most appropriate or how to tailor their ongoing super strategy for optimal outcomes. So, it can be valuable to engage with a professional service that can help you in this area.

SUPER SERVICE

Having awareness is essential because you cannot fix what you do not know is broken.

You can examine the quality of your decisions around super to date by completing a free Super Review at www.superwiser.com.au

You can then decide whether (or not) it is in your best interest to further engage with our services.

Alternatively, if you would like to speak to an adviser call 1800 467 467.

Whether you are 20 or 60 years old, time progresses in the blink of an eye and arriving at your desired financial situation at the point of retirement does not happen by accident. The phrase, wasted time is wasted money, holds a lot of truth, especially with super.

Individuals who effectively manage their super from a young age are more likely to achieve long-term financial goals than those who waste decades before taking appropriate strategic action.

No matter what age you are, if you want to do what is best for yourself, you must consider your level of financial awareness and seek appropriate advice and services where you have knowledge gaps.

Super is complex, and most people have knowledge gaps in this area but fail to take action early enough, thinking they will do it later, closer to retirement. A classic example of wasted time resulting in wasted money as they miss out on opportunities to significantly impact their super outcomes.

START EARLY

Whenever anyone starts their first job, an increase in financial awareness is required. Financial mistakes early in your career are common, and most people remain unaware of the damage they are doing long-term.

Two significant things happen when you commence working, you earn money and start accumulating super.

Initially, your super balance may seem small and insignificant, yet by the time you retire, if wisely managed, you can end up with around a million dollars in your account (in today’s dollars).

The golden rules of super are:

FOR THE OLDER GENERATION

I am sure you know by now that life moves quickly, and some of you will be wishing you had listened earlier.

Whatever you may have done right or wrong so far in life, you must take the perspective of learning from experience and facing reality as it currently is.

Just as there are golden rules for the younger generation, the older generation must ask themselves the following questions:

MOST AUSTRALIANS

Unfortunately, most Australians have limited experience and financial awareness before life after school/TAFE/university takes over, and they have to learn by making mistakes.

Traditionally, the financial services industry only serviced Australians who could afford to pay for expensive financial planning advice (approximately 20% of the top 20% of individuals classed by earnings and assets). Often, these financial planning services only talk to prospects if their assets are $3m or more, meaning that over 90% of the working population does not qualify for traditional financial planning services.

Generally speaking, most Australians do not seek to become financially aware, often choosing the path of doing their best but without the required skills, an approach that most often results in significant financial underperformance.

SUPER MANAGEMENT

If it is possible for almost everyone starting in the workforce today to accumulate a million dollars in super by retirement, how do you get there, and what common mistakes can prevent it from happening?

Misinformation is a word commonly used in recent times, and there is a lot of misinformation (i.e. misleading claims) in the superannuation market about what solution is best for everyone’s super. Super product providers do not service super at an individual account level, and, in some products, most individuals sit in the MySuper investment default and do so without understanding market risk.

The truth is that product providers only provide general advice to individuals and fail to fully explain the limitations and risks of their service model to the market. A product provider will never tell you that another super product is better than theirs, and this is why individuals need to access a service not aligned with a super product.

In searching for such a service, cost is a genuine consideration for most working Australians.

With the rise of technology and automation, quality advice and service specifically focused on super has become more affordable than ever. Look for a service that can review all super product options appropriate to your circumstances to optimise your super and, thereby, lifestyle in retirement.

SUPERWISER

Check out www.superwiser.com.au to examine the value proposition for helping you manage your super more effectively.

Alternatively, if you would like to speak to an adviser call 1800 467 467.

About

Your super is your money. It needs effective management for an optimal outcome. SuperWiser makes it easy to sort out your super. We compare many of Australia’s best-known super funds, identify which ones may better suit your circumstances and help you make timely, well-informed, ongoing strategic decisions, so you can potentially retire earlier and increase your wealth for retirement.

SuperWiser is owned and operated by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately owned company and Corporate Authorised Representative (AR 468201), licensed by AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233680).

© Super Simpler Pty Ltd 2025.

Contact Details

Business Hours

Mon – Fri 8:30am – 5:00pm (AWST)

Office Address

Suite 5, 250 Oxford Street

Leederville WA 6007

Postal Address

PO Box 7259, Cloisters Square

Perth WA 6850

Email

yoursuper@superwiser.com.au

Phone

1800 467 467

Some images used in website by freepik.com