ANNUAL STATEMENT

When reviewing annual super statements, most people are usually happy if investment returns are positive or a bit disgruntled if investment returns are bad. However, they are often unaware of whether they are on track to accumulate enough money to support their desired lifestyle in retirement, as they have not set any formal long-term goals and objectives.

If super is to be optimised for retirement, it must be managed effectively throughout your career. This requires setting goals, implementing strategies to reach said goals and making tactical adjustments when necessary.

There is little point in looking at your statement, having an emotional reaction and then doing nothing to improve your situation. Your annual statement provides data that can be used to monitor your progress toward achieving your long-term goals for retirement and offers the perfect opportunity to review your super strategy and make any necessary tactical adjustments.

Super is mainly about growing your asset, but with an element of defending your asset from time to time and in certain circumstances. Not all asset classes behave the same, and opportunities can arise within a disrupted market.

SUPER AWARENESS

Everyone wants a good result from their super, but not everyone recognises the part they need to play for this to happen. Optimal super outcomes do not materialise by accident. You must set goals, implement a strategic plan, review regularly and make updates as conditions dictate.

Not knowing what to do with your super and when to do it results in missed opportunities, mistakes, and sub-optimal retirement outcomes.

The problem faced by most individuals is that they do not possess the specialised financial skills required to manage their super effectively. The acquisition of such skills would indeed be a full-time occupation.

For individuals who fall into this category, there are benefits to engaging with a financial professional who can offer valuable yet affordable super optimisation advice.

HAVING A GOAL

Having a goal is an essential element of any wealth-creation strategy. The purpose of super is to accumulate enough money throughout your working life to support yourself financially when you retire. Therefore, the first goal you want to establish with super is how much annual income you want it to provide you in retirement.

Next, determine your projected income in retirement based on your current super strategy and compare this against what it could be by making some strategic adjustments.

MONITORING PROGRESS

Retirement can often seem a long way in the future. Calculating at what age you should hit specific account balance milestones will allow you to easily monitor if you are on track to achieve your desired lifestyle in retirement outcome.

For example, you might be 30 years old, your annual income in retirement goal is $35,000, and your accumulated super balance is $110,000. To know that you are on track to reach your goal, you must hit your next account balance milestone of $200,000 by age 35.

AFFORDABLE ADVICE

The global economy is ever-changing, and super product providers limit the information they provide regarding managing your super effectively as a personal asset because they have a vested interest in you staying within their product.

To optimise your projected income in retirement, continual assessment of the appropriateness of your super product is necessary and regular consideration of your contribution and investment strategies is also required.

Super is a personal asset, and no personal asset looks after itself. If you are not reviewing your super annually and making informed strategic choices, then it is unlikely that you will optimise your super over the long term.

Statistics show a large percentage of working Australians are failing to make informed choices regarding their super due to a lack of financial awareness and an inability to access affordable financial advice. However, help is now available, and the introduction of super optimisation technology, such as the online SuperWiser client portal, caters directly to the needs of this demographic.

Individuals can have their super reviewed for free via the SuperWiser client portal. Once a baseline of their projected income in retirement is established (based on their current super strategy), they can choose to obtain initial optimisation advice and regular updates for a fraction of the price charged by traditional financial planners.

SUPERWISER

Irrespective of who your super is with, SuperWiser is an online resource everyone can use to obtain affordable advice and services to optimise super.

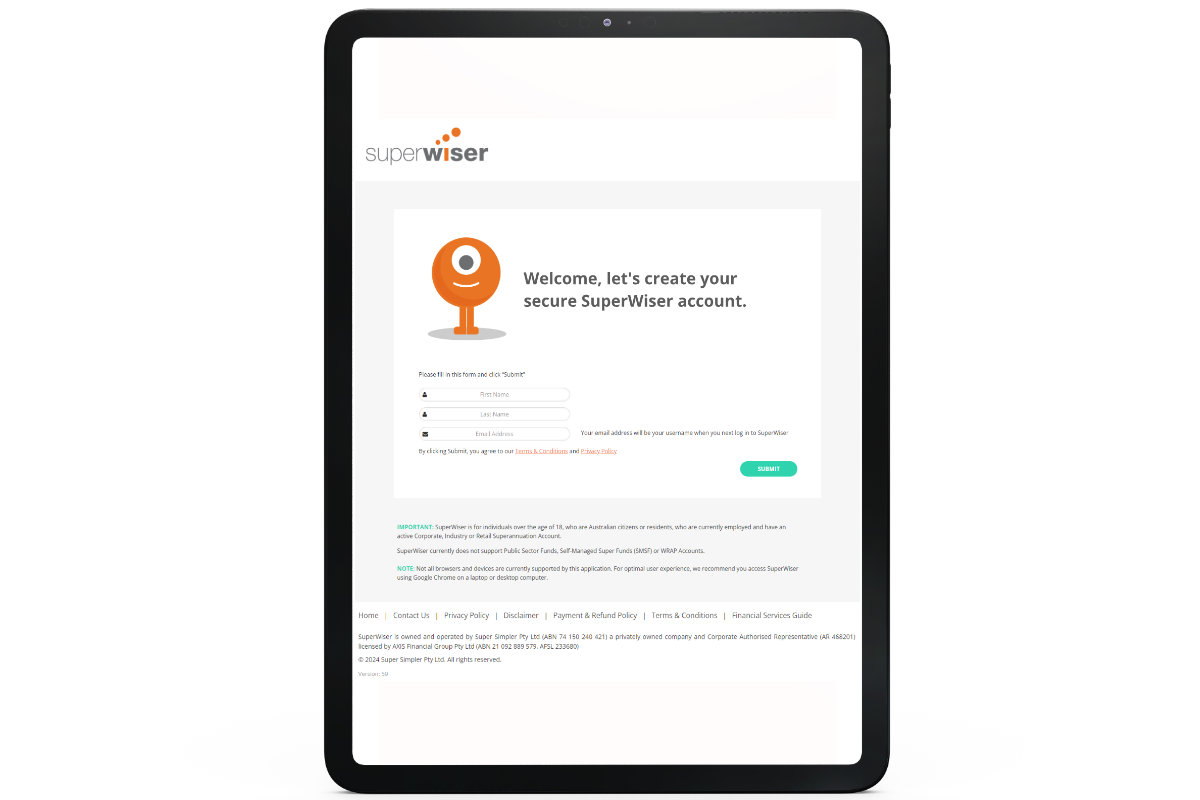

Create your secure SuperWiser account using your email address and then follow the instructions on screen to complete a free super review.

Alternatively, call 1800 467 467 to discuss your options.