SUPER CONTRADICTION

Compulsory super has existed for over 30 years, yet most Australian workers still undervalue the importance of super as a personal asset intended to support their future lifestyle in retirement.

Logic suggests that if you could easily increase your projected income for the first 20 years of retirement by 25% in today’s purchasing power, you would act on it immediately. Australians are smart, yet the numbers suggest otherwise relative to super, with many overlooking serious financial opportunities, resulting in sub-optimal outcomes.

WHAT WENT WRONG?

Introduced in 1992, superannuation was a forward-thinking initiative, one of the most impactful government reforms of its time. But even great ideas can falter with poor execution. And over time, frequent regulatory changes and a lack of clear strategic guidance have weakened its impact.

Despite major investments in systems and platforms that track your super balance, the real tools for making super work for you have received little attention and lack broad awareness. For most people, managing super has meant simply choosing a fund and passively accepting the MySuper default investment for decades. Personalised advice is scarce, and often biased toward the product already selected.

The reality is, every MySuper default has design flaws, yet most Australians remain invested in them due to lack of financial awareness.

PURPOSEFUL PLANNING

Financial success never happens by accident.

Generally, the best outcomes are the result of a purposeful plan that is frequently reviewed and updated as circumstances dictate. Unmonitored investments tend to underperform, especially when left untouched for 30 or 40 years.

Super is unique because the employer funds the asset but the individual employee owns the asset.

The foundation of smart super management is simple and every individual with a super account would benefit from:

- Setting Goals: What income do you want in retirement (in today’s dollars)?

- Establishing a Timeline: What age do you plan to retire?

- Regular Review and Update: Does your strategy require adjustment based on changes in circumstances?

The more attention you pay and the better informed your decisions, the greater your potential retirement income.

PRODUCT MODEL V SERVICED MODEL

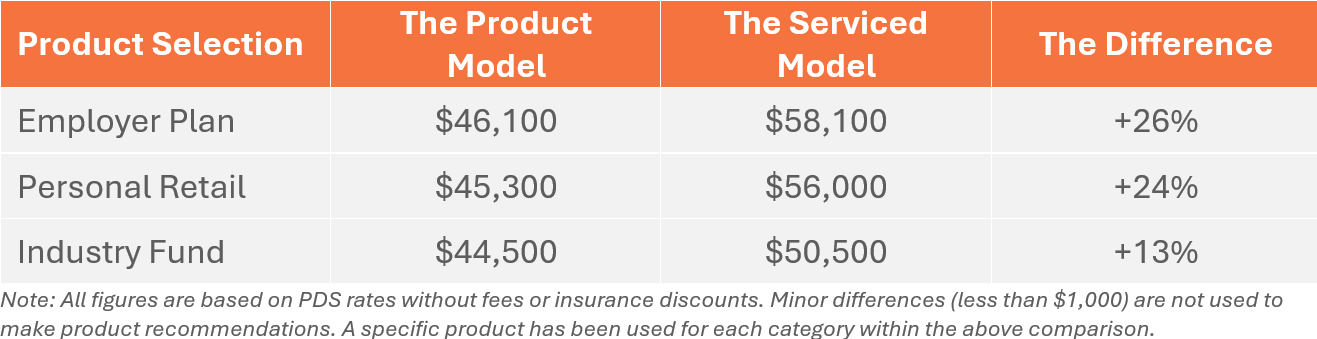

Based on modelling from SuperWiser (using actuarial algorithms), here’s how projected retirement incomes compare for a 30-year-old when super is actively managed (Serviced Model) versus not paying attention (Product Model).

Industry funds, despite their popularity, deliver the lowest projected retirement incomes when compared to the Personal Retail and Employer Plan options.

CONCLUSION

No investment manages itself. The earlier you engage with your super and the more informed your decisions, the better your outcome for retirement.

Super is one of the most significant personal financial assets you will ever own. Understanding how to optimise its value is not just smart, it is fundamental in ensuring your financial security for retirement.

SUPERWISER

Irrespective of who your super is with, SuperWiser is an online resource everyone can use to obtain affordable advice and services to optimise super.

Create your secure SuperWiser account using your email address and then follow the instructions on screen to complete a free super review.

Alternatively, call 1800 467 467 to book an appointment to discuss your options.