SUPER CONTRADICTION

Compulsory super has existed for over 30 years, yet most Australian workers still undervalue the importance of super as a personal asset intended to support their future lifestyle in retirement.

Logic suggests that if you could easily increase your projected income for the first 20 years of retirement by 25% in today’s purchasing power, you would act on it immediately. Australians are smart, yet the numbers suggest otherwise relative to super, with many overlooking serious financial opportunities, resulting in sub-optimal outcomes.

WHAT WENT WRONG?

Introduced in 1992, superannuation was a forward-thinking initiative, one of the most impactful government reforms of its time. But even great ideas can falter with poor execution. And over time, frequent regulatory changes and a lack of clear strategic guidance have weakened its impact.

Despite major investments in systems and platforms that track your super balance, the real tools for making super work for you have received little attention and lack broad awareness. For most people, managing super has meant simply choosing a fund and passively accepting the MySuper default investment for decades. Personalised advice is scarce, and often biased toward the product already selected.

The reality is, every MySuper default has design flaws, yet most Australians remain invested in them due to lack of financial awareness.

PURPOSEFUL PLANNING

Financial success never happens by accident.

Generally, the best outcomes are the result of a purposeful plan that is frequently reviewed and updated as circumstances dictate. Unmonitored investments tend to underperform, especially when left untouched for 30 or 40 years.

Super is unique because the employer funds the asset but the individual employee owns the asset.

The foundation of smart super management is simple and every individual with a super account would benefit from:

The more attention you pay and the better informed your decisions, the greater your potential retirement income.

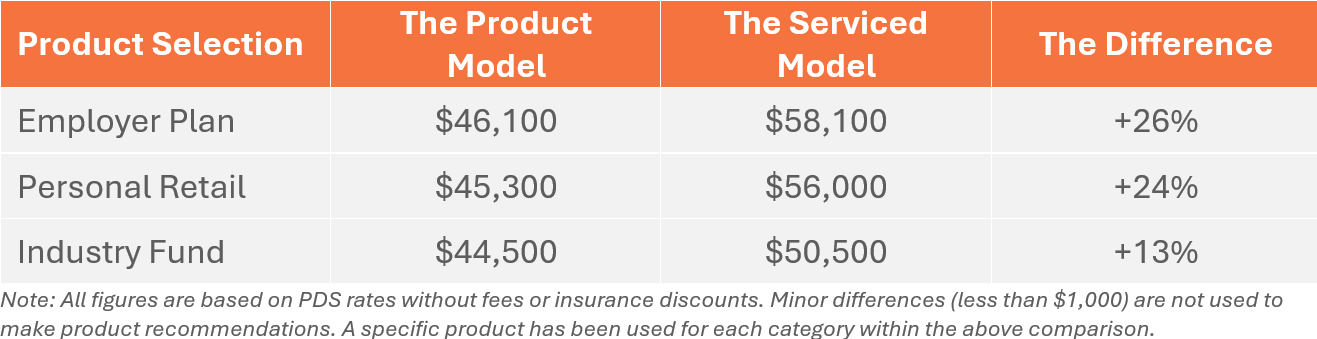

PRODUCT MODEL V SERVICED MODEL

Based on modelling from SuperWiser (using actuarial algorithms), here’s how projected retirement incomes compare for a 30-year-old when super is actively managed (Serviced Model) versus not paying attention (Product Model).

Industry funds, despite their popularity, deliver the lowest projected retirement incomes when compared to the Personal Retail and Employer Plan options.

CONCLUSION

No investment manages itself. The earlier you engage with your super and the more informed your decisions, the better your outcome for retirement.

Super is one of the most significant personal financial assets you will ever own. Understanding how to optimise its value is not just smart, it is fundamental in ensuring your financial security for retirement.

SUPERWISER

Irrespective of who your super is with, SuperWiser is an online resource everyone can use to obtain affordable advice and services to optimise super.

Create your secure SuperWiser account using your email address and then follow the instructions on screen to complete a free super review.

Alternatively, call 1800 467 467 to book an appointment to discuss your options.

ANNUAL STATEMENT

When reviewing annual super statements, most people are usually happy if investment returns are positive or a bit disgruntled if investment returns are bad. However, they are often unaware of whether they are on track to accumulate enough money to support their desired lifestyle in retirement, as they have not set any formal long-term goals and objectives.

If super is to be optimised for retirement, it must be managed effectively throughout your career. This requires setting goals, implementing strategies to reach said goals and making tactical adjustments when necessary.

There is little point in looking at your statement, having an emotional reaction and then doing nothing to improve your situation. Your annual statement provides data that can be used to monitor your progress toward achieving your long-term goals for retirement and offers the perfect opportunity to review your super strategy and make any necessary tactical adjustments.

Super is mainly about growing your asset, but with an element of defending your asset from time to time and in certain circumstances. Not all asset classes behave the same, and opportunities can arise within a disrupted market.

SUPER AWARENESS

Everyone wants a good result from their super, but not everyone recognises the part they need to play for this to happen. Optimal super outcomes do not materialise by accident. You must set goals, implement a strategic plan, review regularly and make updates as conditions dictate.

Not knowing what to do with your super and when to do it results in missed opportunities, mistakes, and sub-optimal retirement outcomes.

The problem faced by most individuals is that they do not possess the specialised financial skills required to manage their super effectively. The acquisition of such skills would indeed be a full-time occupation.

For individuals who fall into this category, there are benefits to engaging with a financial professional who can offer valuable yet affordable super optimisation advice.

HAVING A GOAL

Having a goal is an essential element of any wealth-creation strategy. The purpose of super is to accumulate enough money throughout your working life to support yourself financially when you retire. Therefore, the first goal you want to establish with super is how much annual income you want it to provide you in retirement.

Next, determine your projected income in retirement based on your current super strategy and compare this against what it could be by making some strategic adjustments.

MONITORING PROGRESS

Retirement can often seem a long way in the future. Calculating at what age you should hit specific account balance milestones will allow you to easily monitor if you are on track to achieve your desired lifestyle in retirement outcome.

For example, you might be 30 years old, your annual income in retirement goal is $35,000, and your accumulated super balance is $110,000. To know that you are on track to reach your goal, you must hit your next account balance milestone of $200,000 by age 35.

AFFORDABLE ADVICE

The global economy is ever-changing, and super product providers limit the information they provide regarding managing your super effectively as a personal asset because they have a vested interest in you staying within their product.

To optimise your projected income in retirement, continual assessment of the appropriateness of your super product is necessary and regular consideration of your contribution and investment strategies is also required.

Super is a personal asset, and no personal asset looks after itself. If you are not reviewing your super annually and making informed strategic choices, then it is unlikely that you will optimise your super over the long term.

Statistics show a large percentage of working Australians are failing to make informed choices regarding their super due to a lack of financial awareness and an inability to access affordable financial advice. However, help is now available, and the introduction of super optimisation technology, such as the online SuperWiser client portal, caters directly to the needs of this demographic.

Individuals can have their super reviewed for free via the SuperWiser client portal. Once a baseline of their projected income in retirement is established (based on their current super strategy), they can choose to obtain initial optimisation advice and regular updates for a fraction of the price charged by traditional financial planners.

SUPERWISER

Irrespective of who your super is with, SuperWiser is an online resource everyone can use to obtain affordable advice and services to optimise super.

Create your secure SuperWiser account using your email address and then follow the instructions on screen to complete a free super review.

Alternatively, call 1800 467 467 to discuss your options.

SIMPLE TRUTHS

Much is said about super, usually either negative or uninformative, making many people hesitate to engage with and optimise it as a personal asset. Most younger people tend to dismiss super as it relates to their long-term financial future. Yet most older people in the final stage of their career before retirement often wish they had made wiser decisions when they were younger.

The simple truth is that life happens, and most people will make mistakes. What is essential is to learn from the experience and adjust your situation accordingly to improve your circumstances.

Super is an area where mistakes and regrets are common, but when you better understand how super works and actively manage it, there is a significant opportunity to end up with an asset well beyond initial expectations.

VALUABLE ASSET

The introduction of compulsory super by Paul Keating back in the nineties is to be praised. However, over the years, there has been much interference and tinkering with new regulations regularly introduced. Despite the inefficiencies still associated with optimally managing super as a personal asset, the nation’s pool of super assets has grown to $3.85 trillion.

Super can be one of your most valuable assets for retirement, ultimately allowing you to fund your desired lifestyle in retirement. When commencing employment, your balance starts small. When managed effectively, it can quickly accumulate into a six-figure balance in about ten years, accelerating from there.

TECHNICAL SKILLS

While the technical skills you need to manage super effectively are hard to acquire, the decisions you need to make to optimise your balance (and thereby your projected income in retirement) become easy when you have access to appropriate information in the following areas:

Most individuals do not possess the specialised financial skills needed to generate this type of information. The acquisition of such skills would indeed be a full-time occupation.

For individuals who fall into this category, there are benefits to engaging with a financial professional who can offer valuable yet affordable super optimisation advice.

GOALS AND OBJECTIVES

Any significant asset needs active financial management. To effectively manage super, you need a target future goal of projected income in retirement (expressed in today’s dollars). Defined short-term milestones provide a measure to track progress towards set goals. Ongoing tactical updates are also necessary as circumstances and conditions dictate.

As you progress through your career, your circumstances change as your time horizon shortens and your balance accumulates. Early in your career, you chase growth and will therefore expose your super asset to shares and property. As you age and your super balance grows, a more defensive position is required (eventually), where a higher proportion of the asset is invested in cash and fixed interest.

To personally target super as a key source of income in retirement, you need some financial awareness of your investment portfolio and the rationale behind any investment advice and subsequent modification to your investment strategy. As a personal asset, it is better to manage super actively. This means making regular strategic adjustments based on ongoing 2-year market outlooks.

No matter your age, super is important. Failing to manage it appropriately can have significant financial consequences.

SUPER OPPORTUNITIES

There are always unknown surprise opportunities to optimise your super further that can arise with changes to legislation and regulations and when you get close to retirement. So, keeping up to date with available options is advisable.

Whenever your job circumstances change, such as getting a promotion or changing employer, always ensure you review your super strategy and recalibrate your goals and milestones. Later in life, you might want to go part-time as a halfway step towards full retirement. A transition to retirement strategy could become beneficial at this point.

Access to relevant information and specialist knowledge is essential to manage super optimally.

HELP IS AVAILABLE

Not knowing what to do with your super and when to do it results in missed opportunities, mistakes, and sub-optimal retirement outcomes.

Irrespective of who your super is with, SuperWiser is an online resource everyone can use to obtain affordable advice and services to optimise super.

Create your secure SuperWiser account using your email address and then follow the instructions on screen.

Alternatively, call 1800 467 467 to discuss your options.

PAY ATTENTION

There is much confusion around superannuation. No one knows what to believe, yet everyone must make decisions. The government’s direction on super appears to continually change. Occasionally, there is a clear directional signal, but the reaction from the public (who own the asset) is minimal or absent.

Everyone with a super account must understand that super is a personal asset, which means the responsibility for how well (or poorly) it performs as a wealth creation asset is down to them.

Ineffective management of your super asset can result in around 20% to 40% less income in retirement.

KEY DECISIONS

There are four key areas that impact super outcomes:

If you are to optimise your super asset these four areas require regular review and updates made at appropriate times.

Some additional points to note are:

INFORMATION AND ADVICE

You may be wondering how to accumulate and maintain the financial knowledge needed to appropriately compare current options offered by the financial services market to optimise super as it requires a specialised skill set and analysis of up-to-date of relevant information.

The SuperWiser client portal fulfils this purpose specifically. It provides access to the information necessary to make informed, strategic decisions and advice around optimally managing your super as a personal wealth creation asset.

JUSTIFIED IMPORTANCE

For anyone unsure of the importance of super, a brief review of its history provides some perspective.

HELP IS AVAILABLE

Not knowing what to do with your super and when to do it results in missed opportunities, mistakes, and sub-optimal retirement outcomes.

Optimising your super asset requires effective management, which means setting goals, monitoring progress against milestone targets, and making timely, well-informed strategic decisions as required.

Use SuperWiser to complete a free super review. You can then make informed decisions and consider the cost benefit of obtaining formal super optimisation advice.

Create your secure SuperWiser account using your email address and then follow the instructions on screen.

Alternatively, call 1800 467 467 to discuss your options.

About

Your super is your money. It needs effective management for an optimal outcome. SuperWiser makes it easy to sort out your super. We compare many of Australia’s best-known super funds, identify which ones may better suit your circumstances and help you make timely, well-informed, ongoing strategic decisions, so you can potentially retire earlier and increase your wealth for retirement.

SuperWiser is owned and operated by Super Simpler Pty Ltd (ABN 74 150 240 421) a privately owned company and Corporate Authorised Representative (AR 468201), licensed by AXIS Financial Group Pty Ltd (ABN 21 092 889 579, AFSL 233680).

© Super Simpler Pty Ltd 2025.

Contact Details

Business Hours

Mon – Fri 8:30am – 5:00pm (AWST)

Office Address

Suite 5, 250 Oxford Street

Leederville WA 6007

Postal Address

PO Box 7259, Cloisters Square

Perth WA 6850

Email

yoursuper@superwiser.com.au

Phone

1800 467 467

Some images used in website by freepik.com